Prin Declarația 177, poți solicita ANAF să redirecționeze către Asociația Salvează o inimă bugetul de sponsorizare rămas nealocat în 2025.

Suma aferentă contractului de sponsorizare ne va fi virată de către ANAF în termen de 45 de zile.

Poți direcționa până la 20% din impozitul pe profit datorat statului în anul 2026 către Asociația ”Salvează o inimă”.Folosește impozitul pentru o cauză nobilă și ajută la îmbunătățirea sănătății celor mai greu încercați ca noi.

Puteti dona direct prin transfer bancar in urmatoarele conturi:

Puteti dona direct prin transfer bancar in urmatoarele conturi:

RON:RO94 RNCB 0041 1821 0401 0001

Euro:RO67 RNCB 0041 1821 0401 0002

Sponsorizarea prin direcționarea a până la 20% din impozitul pe profit

Sponsorizarea prin direcționarea a până la 20% din impozitul pe profit este o formă legală și eficientă prin care o companie poate susține o cauză socială fără niciun cost suplimentar. Nu presupune o cheltuială în plus, ci redirecționarea unei părți din impozitul pe profit deja datorat către un ONG eligibil, înscris în Registrul ANAF.

O firmă poate direcționa până la 20% din impozitul pe profit, în limita a 0,75% din cifra de afaceri, prin încheierea unui contract de sponsorizare și efectuarea plății către organizația aleasă. Suma este dedusă din impozitul datorat statului, astfel că impactul social nu se reflectă într-un efort financiar suplimentar pentru companie.

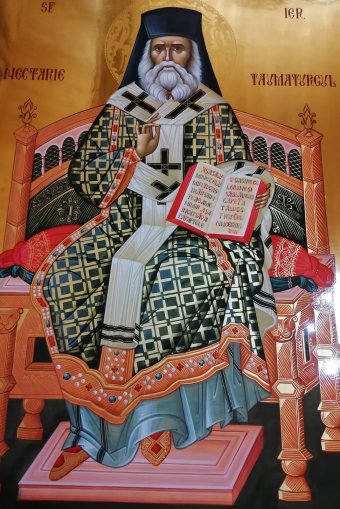

De ce către Asociația „Salvează o inimă”

Asociația „Salvează o inimă” transformă această facilitate fiscală în sprijin concret pentru copiii diagnosticați cu afecțiuni grave. De-a lungul activității sale, asociația a contribuit la salvarea a peste 1.600 de copii, oferindu-le acces la intervenții chirurgicale, tratamente și programe de recuperare în spitale și clinici din țară și din străinătate.

Rezultatele sunt susținute de încrederea a peste 132.000 de persoane și 1600 de companii care au ales să direcționeze fonduri într-un mod transparent și responsabil. Peste 26 de milioane de euro au fost mobilizați și utilizați exclusiv pentru scopuri medicale, acolo unde fiecare decizie contează și fiecare zi este esențială.

Pentru Asociația „Salvează o inimă”, sponsorizarea din impozitul pe profit înseamnă continuitate, stabilitate și posibilitatea de a interveni la timp. Pentru companii, înseamnă un parteneriat bazat pe transparență, cu raportare clară asupra modului în care fondurile sunt utilizate și asupra impactului generat.

O decizie fiscală cu impact real

Direcționarea a până la 20% din impozitul pe profit către Asociația „Salvează o inimă” este o alegere care depășește sfera contabilă. Este o decizie prin care o obligație fiscală se transformă într-o investiție în viață, în speranță și în viitorul unor copii care depind de intervenții medicale la timp.

📄 Ce este formularul D177?

Formularul D177 este o declarație pe care firmele o pot trimite online la ANAF, ca să direcționeze o parte din impozitul pe profit sau pe venit către un ONG sau o cauză socială (cum ar fi un spital, o asociație, o fundație etc.).

Este o modalitate legală de sponsorizare fără ca firma să scoată bani din buzunar în plus.

🧾 Cum funcționează?

Firma face o sponsorizare către un ONG eligibil (acreditat, inclus în registrul ANAF).

După sponsorizare, firma completează formularul D177.

ANAF redirecționează automat suma respectivă din impozitul deja datorat de firmă – deci nu e un cost suplimentar.

Dacă firma n-a apucat să facă sponsorizarea în timpul anului, o poate face retroactiv, prin D177, în termen de 6 luni de la termenul de depunere al declarației de impozit.

📌 Ce trebuie știut:

Se poate direcționa maximum 20% din impozitul pe profit sau pe venit, dar și în limita a 0,75% din cifra de afaceri.

ONG-ul trebuie să fie înscris în Registrul entităților/unităților de cult, la ANAF.

Sponsorizarea trebuie să fie făcută cu contract, iar suma trebuie plătită efectiv înainte de a trimite D177.

D177 se depune doar online, prin SPV (Spațiul Privat Virtual).

CE RAMANE DE FACUT?

Totul se rezumă la încheierea unui Contract de Sponsorizare între firma dvs. şi ONG, în baza căruia banii pot fi deduşi din impozitul pe profit. În urma folosirii sumei donate, veţi primi un raport asupra modului în care banii dumneavoastră au fost cheltuiti şi al impactului pe care l-au avut în viaţa celor ce au avut nevoie de noi.

Placinta Vlad Dumitru

Președinte Asociația Salvează o inimă

email: office@salveazaoinima.ro

tel: +40 752 753 540

Andreea Amarandei

Manager Fundrasing Companii

tel +0748 976 613

email: andreea.amarandei@salveazaoinima.ro