You can donate directly by bank transfer to the following accounts:

You can donate directly by bank transfer to the following accounts:

RON:RO94 RNCB 0041 1821 0401 0001

Euro:RO67 RNCB 0041 1821 0401 0002

📄 What is Form D177?

Form D177 is a declaration that companies can send online to ANAF, in order to direct part of the profit or income tax to an NGO or a social cause (such as a hospital, an association, a foundation, etc.).

It is a legal way of sponsorship without the company taking extra money out of its pocket.

🧾 How does it work?

The company sponsors an eligible NGO (accredited, included in the ANAF register).

After sponsorship, the company fills in form D177.

ANAF automatically redirects that amount from the tax already owed by the company – so it is not an additional cost.

If the company has not had the opportunity to sponsor during the year, it can do so retroactively, through D177, within 6 months from the deadline for submitting the tax return.

📌 What you need to know:

A maximum of 20% of the corporate or income tax can be directed, but also within the limit of 0.75% of the turnover.

The NGO must be registered in the Register of Religious Entities/Units, at ANAF.

Sponsorship must be done with a contract, and the amount must be actually paid before sending D177.

D177 is submitted only online, through the SPV (Virtual Private Space).

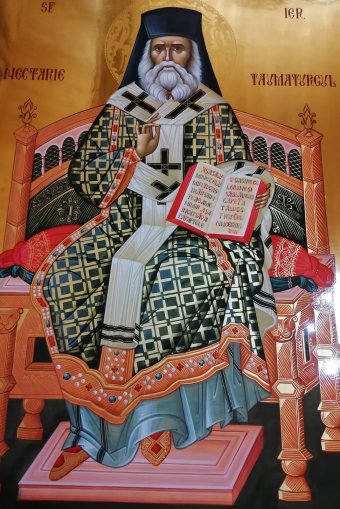

A little bit about US!!

2024 was a busy year for the "Save a Heart" Association. Full of humanitarian campaigns, but also of successes that have made our souls happy and have given us hope and confidence that this year we will change the future of children condemned by serious illnesses for the better.

So far we have saved over 1300 little ones, thanks to the 128,200 people who understood that any amount donated can make the difference between life and death.

Together we raised more than 24,000,000 euros, money that reached clinics and hospitals in the country and abroad, where children were operated on and benefited from treatments and recovery at high standards.

Any donation counted, whether it was 2 euros through an SMS, 5,000 euros through the card or over 200,000 euros through sponsorships.

There is also a form of financial aid that costs nothing. It is about 20% on profit or income tax in the case of legal ones.

Companies can also lend us a hand, as they have done so far: also on our website, in the "Direct" menu, there is also the sponsorship contract

In this case, 20% of the corporate tax can mean new lives saved.

You don't have to believe us. See for yourself! Enter the www.salveazaoinima.ro website, search for details about us in the thousands of media appearances and donate as much as possible to one of the cases we handle.

WHAT REMAINS TO BE DONE?

It all comes down to the conclusion of a Sponsorship Agreement between your company. and NGOs, based on which the money can be deducted from the corporate income tax. As a result of using the donated amount, you will receive a report on how your money was spent and the impact it had on the lives of those who needed us.